In most cases, you do not need to register a loan agreement between friends and family with the Land Registry. If you’re making an unsecured, private loan to a friend or family member, you can formalise the arrangement in an agreement, and that’s all you need to do. To make sure that agreement fits your needs and is properly drafted to avoid common regulatory pitfalls we recommend involving a solicitor.

However, if you’re giving a loan and you’re securing it against land or a property, then you will need to register it on the Land Registry.

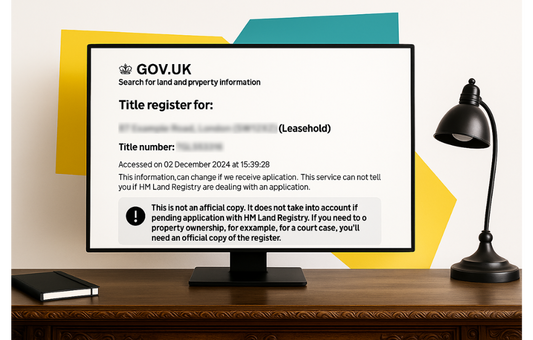

How can you check if the loan is registered?

If you’ve ever looked at Registered Title documents for a property, you’ll see that there’s a section for Charges. If the house was purchased with the help of a mortgage, this is where you’ll find the commercial lender’s charge. With a charge registered against the property, it means that the borrower cannot sell the property without repaying the loan. Indeed, the ability to deal with the property in any way is often diminished.

A private loan secured against a property is another type of charge, and it will be registered in the same section on the title documents.

You can read more about reading a title register here on the government’s website.

How do you register the charge?

We’d strongly recommend asking a solicitor to register the loan for you. There are several forms we need to fill out and which forms are correct will depend on your circumstances.

How is the charge removed?

When the borrower has repaid the loan in full, the lender completes a DS1 form. This is then submitted to the Land Registry and the charge is removed. The borrower is free to sell the property without reference to the lender after that.