You’ve decided that it’s time to write your Will. What next?

These are the things you should be clear about before you begin.

Make a list of your assets

This was probably top of your list anyway, but the first thing to think about is the assets you own. You can be expansive about this. Include things like:

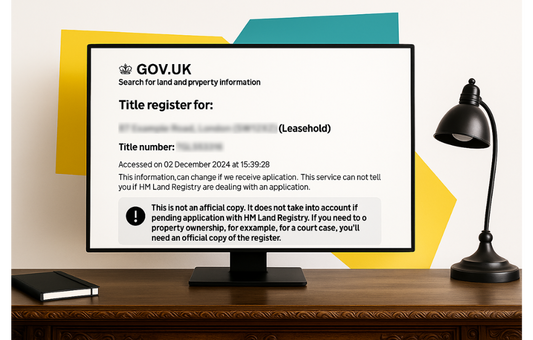

· Your house, and any other land or property you own in the UK or abroad

· Your savings and investments

· Pension pots

· Car and any other vehicle

· Jewellery and watches

· Antiques and family heirlooms

Once you have a comprehensive list of your assets, you can start to think about how you might distribute them.

Consider your liabilities

Some people forget that when you die, you don’t just pass on your assets; you also leave behind your liabilities.

If you have a mortgage, any loans, or any other debts, please list them out. Give details about who the lender is, and how much you owe at the current date, and how much you repay each month.

Often your debts can be settled from the estate. But it makes the job of finalising your estate much easier if everybody is clear about who is owed what.

For more information on how debts are treated after you die, read more on the Government’s Money Helper website.

Choose your beneficiaries

A good place to start with this is to create a family tree. Include each family member’s date of birth if possible too.

You may choose to leave something to friends, or carers, or other important people in your life who aren’t family. If you can make a list of these people, with their addresses and dates of birth, that will help your executors to identify the right people.

You might also want to leave a legacy to your favourite charity, or a sports club that’s close to your heart. You can leave money to as many different organisations as you like.

Then decide who you would like to inherit which of your assets. You can do this in a simple table, or excel spreadsheet.

Don’t forget that it’s possible that you may live longer than some of your chosen beneficiaries. It’s important to make provision for alternative beneficiaries if the first-named person is no longer alive.

Consider Guardians for children under 18

One of the most pressing reasons for making a Will is if you have children under the age of 18. You want to make sure that they are looked after if both parents die suddenly. If one parent dies, then the other parent looks after the children. But if both parents are no longer around, or one parent is unable to care for the children, what happens then?

You can appoint Guardians in your Will to look after your children. These could be trusted friends, siblings, cousins, or anyone you would feel comfortable caring for your children.

It’s best to have this conversation with your chosen Guardians before writing it into your Will.

Should you set up a Trust?

You might consider setting up a Trust in your Will. You’d usually do this either to (i) delay when your children inherit money from your estate, or (ii) provide for a child with disabilities.

You may want your children only to inherit money when you deem them financially responsible. By setting up a Trust, you can delay their inheritance until they reach the age of 25 (for example). You can choose the age at which you’d like them to have access to the Trust.

A child with disabilities may be receiving certain benefits that could be impacted by the inheritance they receive from your estate. To make sure they keep receiving the benefits they’re entitled to, the assets you leave them can be held in a Trust and distributed periodically.

It’s worth noting that trusts can come in different forms with different legal implications. Again, this is something to discuss with your advisor when you have a consultation.

Choose your executors

Your executors are the people legally responsible for carrying out your wishes in the Will and distributing your assets. You can appoint up to four people for this role, but remember that they will be working closely together so they should be able to get on well. Most people appoint one or two executors.

They should be people that you trust, and people you think are sufficiently responsible and capable of doing the job.

If you think it might be too high a burden for somebody you know, you can appoint professionals, like private client solicitors. Remember that they will charge for their work, but they are experts in this field and will be able to work quickly, efficiently, and accurately.

Pets

We know how beloved your pets are and you’ll want to make sure they’re cared for too. You can ask friends or family to look after your pets in your Will.

Information for your Letter of Wishes

Your Letter of Wishes is not a legally binding document in the same way that a Will is. Instead, people use it to express preferences, such as what they’d like to happen at their funeral. You might also use this space to explain any decisions you’ve made that might be controversial.

A Letter of Wishes is usually stored with the Will but is not legally binding. It provides guidance to your executors and is often private—not necessarily seen by all beneficiaries unless disclosed.

Inheritance tax

Inheritance tax is quite a complicated subject and we can discuss it at your consultation, if you’re having one.

The main point to note is that you pay no inheritance tax on the first £325,000 of your estate (the nil-rate band). After that, the rate is generally 40%. There may be additional reliefs and exemptions available but this will depend on your circumstances.

However, there are a number of ways around that. For one, if you leave your estate to a surviving spouse, then no inheritance tax is payable. And any unused allowance is transferred to a surviving spouse, so their nil-rate band could be as high as £650,000.

There are other ways to reduce your inheritance tax liability, and again it will depend on your circumstances (such as whether you’re married and have children etc). This might affect how you distribute your estate, so it’s worth thinking about before you finalise your Will.

Keep it updated

While this post is all about creating your Will, give some thought to keeping it up to date once it is written. Your circumstances may change—marriage, divorce, new children, or significant changes to your estate may all mean your Will needs updating. It's a good idea to review your Will every few years.

How we can help

If you’d like a professional to draft your Will for you, please get in touch.

We can make sure that your Will is valid and binding, and that it accurately reflects your wishes and makes provision for a range of possible circumstances.

Please do get in touch if you have any questions, or you’d like any further information.